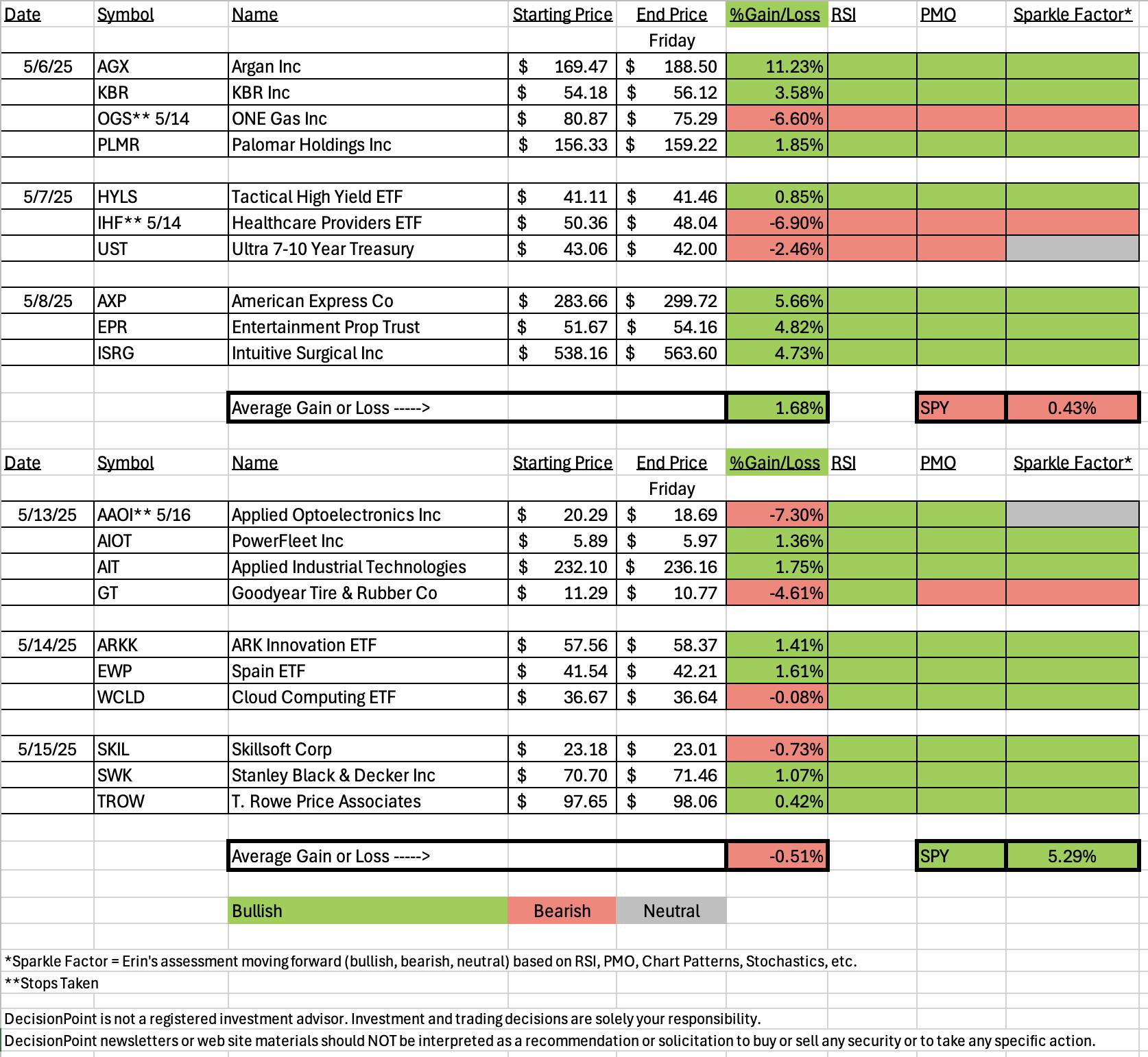

This week's average for "Diamonds in the Rough" was negative which isn't good given the SPY was up over 5% this week, but I'm happy with what we have as the majority of positions are in the green.

We had two very bad positions (one hit its stop) and that took down our average, but even without those positions, the average wouldn't have touched what the SPY did. It's been rough picking in this market as my scans have abandoned me right now. I would suggest if you are having trouble with your own scans, use the US Industries report on StockCharts and drill down like we do in the Diamond Mine. I think you may have better success that way. I think I'll be doing that moving forward if I'm not thrilled with scan results.

This week's "Darling" was Applied Industrial Technologies (AIT). This one took advantage of the strength in Industrials. The "Dud" this week was Applied Optoelectronics Inc (AAOI) which hit its stop today. The chart doesn't look that bad though. We'll discuss later.

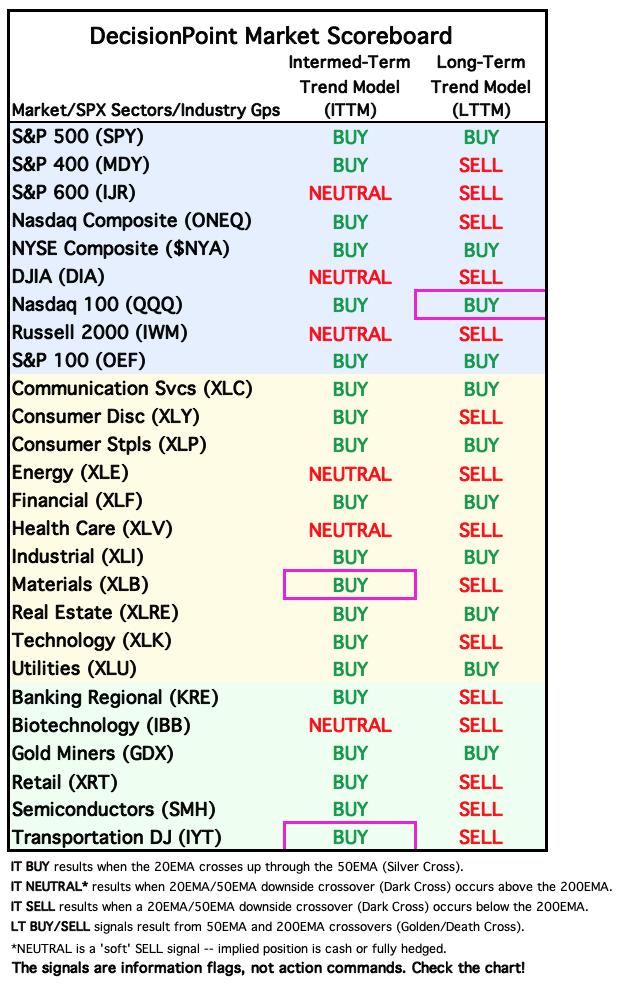

The Sector to Watch this week is Technology (XLK). I wasn't sure where to go so as a group in the Diamond Mine we picked Technology. Consumer Discretionary (XLY) was a close second in my opinion. The market is still clicking and these two areas will likely outperform on the way up.

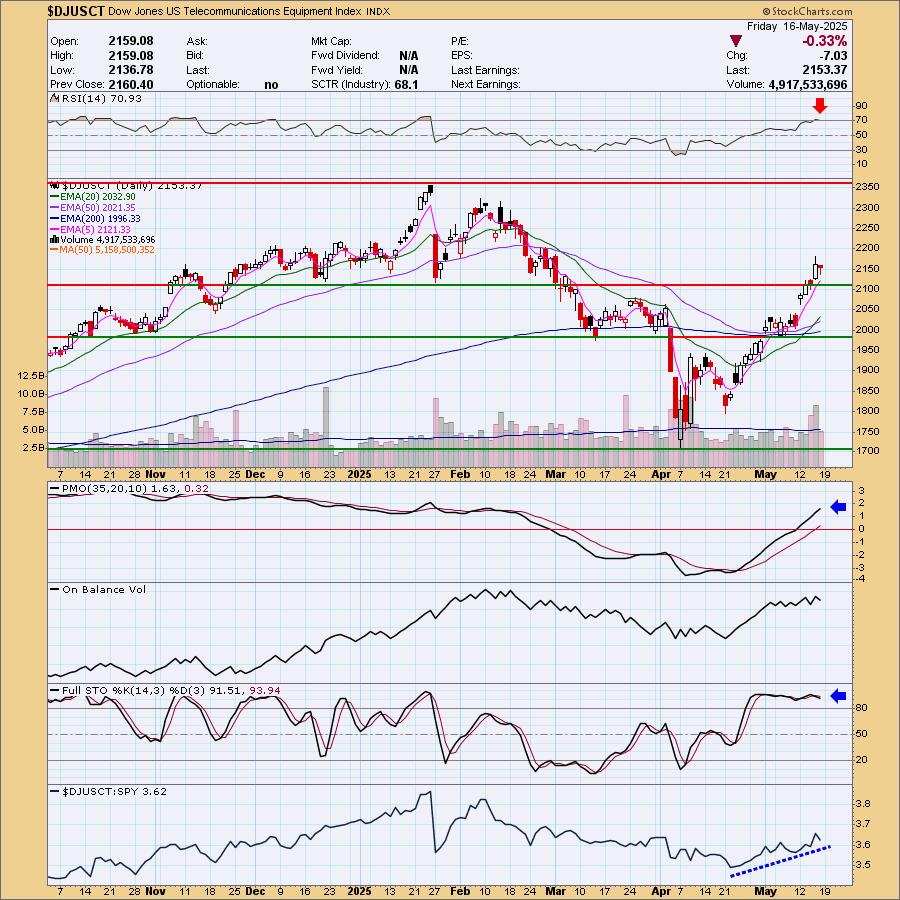

The Industry Group to Watch was Telecom Equipment. I was able to find a handful of stocks within for your review: CRDO, CIEN, EXTR, LITE and GLW. Some of these are overbought, but they are in great rallies and that condition can persist.

I did run some scans at the end of the trading room and I did find some symbols for your review: BRO, LDOS, HIG, CTAS and EBAY. However, I also want to give you the requested symbols this morning. Readers picked up some GREAT looking charts today so you should take a look at: BROS, DAPP, ARM, VIPS, RKT, OKLA and FULC. Those I liked best. Upside potential is excellent on most of these. Have fun checking them out!

Have a great weekend!

Good Luck & Good Trading,

Erin

* * * * * * * * * * * * * *

Carl has decided to retire, and Erin will be joining him in retirement. We will continue publication until June 27th, and we have already sent notice via email as to how this will affect your subscriptions. Contact us with any questions.

* * * * * * * * * * * * * *

Diamond Mine Trading Room:

RECORDING & DOWNLOAD LINK (5/16/2025):

Topic: DecisionPoint Diamond Mine (5/16/2025) LIVE Trading Room

Download & Recording Link

Passcode: May#16th

REGISTRATION for 5/23/2025:

When: May 23, 2025 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Applied Industrial Technologies Inc. (AIT)

EARNINGS: 2025-08-14 (BMO)

Applied Industrial Technologies, Inc. engages in the manufacture and distribution of industrial parts and products. It operates through the Service Center Based Distribution and Engineered Solutions segments. The Service Center Based Distribution segment is involved in local service centers and distribution centers with a focus on providing products and services addressing the maintenance and repair of motion control infrastructure and production equipment. The Engineered Solutions segment focuses on distributing, engineering, designing, integrating, and repairing hydraulic and pneumatic fluid power technologies, and engineered flow control products and services. The company was founded by Joseph Bruening in January 1923 and is headquartered in Cleveland, OH.

Predefined Scans Triggered: Bullish MACD Crossovers and Parabolic SAR Buy Signals.

Below are the commentary and chart from Tuesday, 5/13:

"AIT is unchanged in after hours trading. This is from the Sector to Watch, Industrials. I spotted a reverse head and shoulders pattern that is developing. The RSI is positive and the PMO is rising and should get above zero momentarily. Stochastics are rising. Relative strength for the group is on par with the SPY which is fine as the SPY is rallying. AIT is starting to outperform both the group and the SPY. The stop is set beneath support at 7.9% or $213.76."

Here is today's chart:

Not really an exciting chart, but it is working on confirming the reverse head and shoulders pattern. I would look for a breakout at the next level of overhead resistance. The PMO is still rising and is now above the zero line. Stochastics have tipped upward promising more upside. Relative strength is basically rising at this point. This could be an interesting entry.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Applied Optoelectronics Inc. (AAOI)

EARNINGS: 2025-08-07 (AMC)

Applied Optoelectronics, Inc. engages in the design and manufacture of optical communications products. Its products include optical devices, such as laser diodes, photodiodes, related modules and circuitry, and equipment for applications in fiber-to-the-home, cable television, point to point communications, and wireless. The company was founded by Chih Hsiang Lin on February 28, 1997 and is headquartered in Sugar Land, TX.

Predefined Scans Triggered: P&F Triple Top Breakout, Entered Ichimoku Cloud and P&F Double Top Breakout.

Below are the commentary and chart from Tuesday, 5/13:

"AAOI is down -0.99% in after hours trading. This looks like a good bottom. Price has gotten above the 200-day EMA. It had a blowout day so we could see a small pullback tomorrow. I like that the declining trend has been broken. The RSI is overbought right now, but we can see it can hold those conditions for quite sometime based on November. The PMO is now accelerating above the zero line. Stochastics are holding above 80. Relative strength is rising across the board. We even have the OBV rising and therefore confirming this rally. The stop is set beneath the 200-day EMA at 7.3% or $18.80."

Here is today's chart:

My best guess as to why this one turned out to be a dud is due to the overbought RSI. It got ahead of itself, but I was looking back to November and it had held overbought conditions for some time so I felt we could go with it even though it had just gotten overbought. It didn't work out. The chart doesn't look terrible as the PMO is still rising and the RSI is positive. I leave it up to you as to whether you want to take a chance on this one now that it has pulled back. It is in our Industry Group to Watch, so it does have some merit based on a good group.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Friday signal changes are outlined in purple.

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Technology (XLK)

Tech is leading the charge on the way up. Participation is incredibly strong right now but it is overbought. Still those conditions can persist if the rally is strong enough and this one does look strong. It is the sector with the highest PMO value. The RSI is overbought right now so it is due for a pause, but ultimately I do think this sector will lead the market higher. Look at the strong Silver Cross Index. Admittedly it is getting overbought, but again that condition can persist in a big bull market move like the one we're seeing.

Industry Group to Watch: Telecommunications Equipment ($DJUSCT)

Out of the gate I do see that this group got overbought today on the RSI. It can hold these conditions as we've seen in the past and this rally is strong enough to expect overbought conditions to persist. We have a relatively new Silver Cross of the 20/50-day EMAs. The PMO is rising strongly above the zero line on a Crossover BUY Signal. Stochastics look incredibly strong as they hover above 80. I think there is more upside available here. I did find some symbols, but some of them are a little overbought, but they are definitely worth a look: CRDO, CIEN, EXTR, LITE and GLW.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 70% long, 0% short. I own EXTR. I'm contemplating adding a few of those reader requests from the Diamond Mine today which is why I mentioned those symbols in the intro.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin HERE!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2025 DecisionPoint.com